2021 ev charger tax credit

Up to 7500 federal income tax credit for purchase of new electric vehicle Not available for GM or Tesla Up to 30 federal tax credit to install charging equipment Install by 123121 Up to 1000 for home installations Up to 30000 for businesses Electric Vehicle Federal Incentives. So if you recently installed a home EV charging station or completed a large-scale EV infrastructure project you might still be eligible for this.

Joe Biden Releases New Ev Charging Plan Protocol

Receive a federal tax credit of 30 of the cost of.

. The credit is the smaller of 30 or 1000. As of February 2022 residents in any state can get an income tax credit to help defray the cost of both EV chargers and EV charger installations. Plug In Electric Drive Vehicle Credit Section 30D Internal Revenue Service.

Residential installation can receive a credit of up to 1000. Unlike some other tax credits this program covers both EV charger hardware AND installation costs. All of these things have tax credits associated with them but Im trying to figure out how to get some of it carried over in turbotax instead of losing it.

The tax credit now expires on December 31 2021. The EV tax credit is 7500 the EVSE credit on our station is 1000 and our solar credit is 8800. To qualify for the credit the property needs to be operational in the tax year and used predominately inside the United States.

Beginning on January 1 2021. The federal tax credit covers 30 of an EV charging station necessary equipment and installation costs. Purchasing an EV Charging Station in 2021.

Up to 1000 Back for Home Charging. The proposed EV incentive under Build Back Better includes a current 7500 tax credit to purchase a plug-in electric vehicle as well as. The credit begins to phase out for a manufacturer when that manufacturer sells 200000 qualified vehicles.

Similar tax breaks have expired and been extended in recent years and in its current form it applies to property placed. A federal tax credit is available for 30 of the cost of the charger and installation up to a 1000 credit means 3000 spent. This incentive covers 30 of the cost with a maximum credit of up to 1000.

The credit attributable to depreciable property refueling property used for business or investment purposes is treated as a general business credit. A rather significant federal tax benefit is available to most taxpayers who recently installed electric vehicle charging stations and it seemingly is a feature that flew under the radar for many. Effective October 1 2021 until January 1 2027 Report.

The IRS tax credit for 2021 Taxes ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US. Form 8911 is used to figure a credit for an alternative fuel vehicle refueling property placed in service during the tax year. This nonrefundable credit is calculated by a base payment of 2500 plus an additional 417 per kilowatt hour that is in excess of 5 kilowatt hours.

The tax credit now expires on December 31 2021. The federal tax credit was extended through December 31 2021. Just buy and install by December 31 2021 then claim the credit on your federal tax return.

Must be purchased and installed by December 31 2021 and claim the credit on your federal tax return. If so we have great news for you. For residential installations the IRS caps the tax credit at 1000.

Use this form to figure your credit for alternative fuel vehicle refueling property you. The federal 2020 30C tax credit is the largest incentive available to businesses for installing EV charging stations. Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station up to 1000 for residential installations and up to 30000 for commercial installations.

The credit ranges between 2500 and 7500 depending on the capacity of the battery. The Taxpayer Certainty and Disaster Tax Relief Act of 2020 extended the alternative fuel vehicle refueling property credit to cover such properties placed in service in 2021. Learn How ChargePoint EV Charging Will Benefit Your Business And Produce ROI.

The Build Back Better bill will increase the current electric car tax credit from 7500 to 12500 for qualifying vehicles. It applies to installs dating back to January 1. The US Federal Tax Credit gives individuals 30 off a Home Electric Vehicle charging station plus installation costs.

Since installation costs are significant for EV chargers this rule allows you to get the most tax credit for your. And April 7 2021. Heres how to claim your credit for 30 of the cost of your home charger and installation up to 1000.

Congress recently passed a retroactive federal tax credit including costs for EV charging infrastructure. Furthermore Future Energy expects federal tax incentives to be quite robust in 2022. How to Claim Your Federal Tax Credit for Home Charging You might have heard that the federal tax credit for EV charging stations was reintroduced recently.

In most cases that means all you have to do to qualify is install charging equipment on your businesss property and submit an application for credit. Congress recently passed a retroactive federal tax credit for those who purchased environmentally responsible transportation including costs for EV charging infrastructure. Can I get a credit if I install an EV charger.

By Andrew Smith February 11 2022. Ad Incentives Subscription Pricing Make EV Charging With More Affordable Than Ever. SUBJECT Electric Vehicle Charging Credit SUMMARY The bill provides under the Personal Income Tax Law PITL and Corporation Tax Law CTL a 40 percent credit for costs paid or incurred to the owners or developers of multifamily residential or nonresidential buildings for the installation of electric vehicle.

The tax credit is retroactive and you can apply for installations made from as far back as 2017. From what I see our total tax liability is 12k for 2021. Federal tax credit gives individuals 30 back on a ChargePoint Home Flex EV charger and installation costs up to 1000.

Co-authored by Stan Rose. Where To Find EV Charging-Station Tax Credits. Beginning July 1 2024 25 percent of any unused funds remaining in the Fund at the end of the fiscal year shall be reallocated to fund electric vehicle charging infrastructure as approved by the General Assembly.

Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station up to. Grab IRS form 8911 or use our handy guide to get your credit.

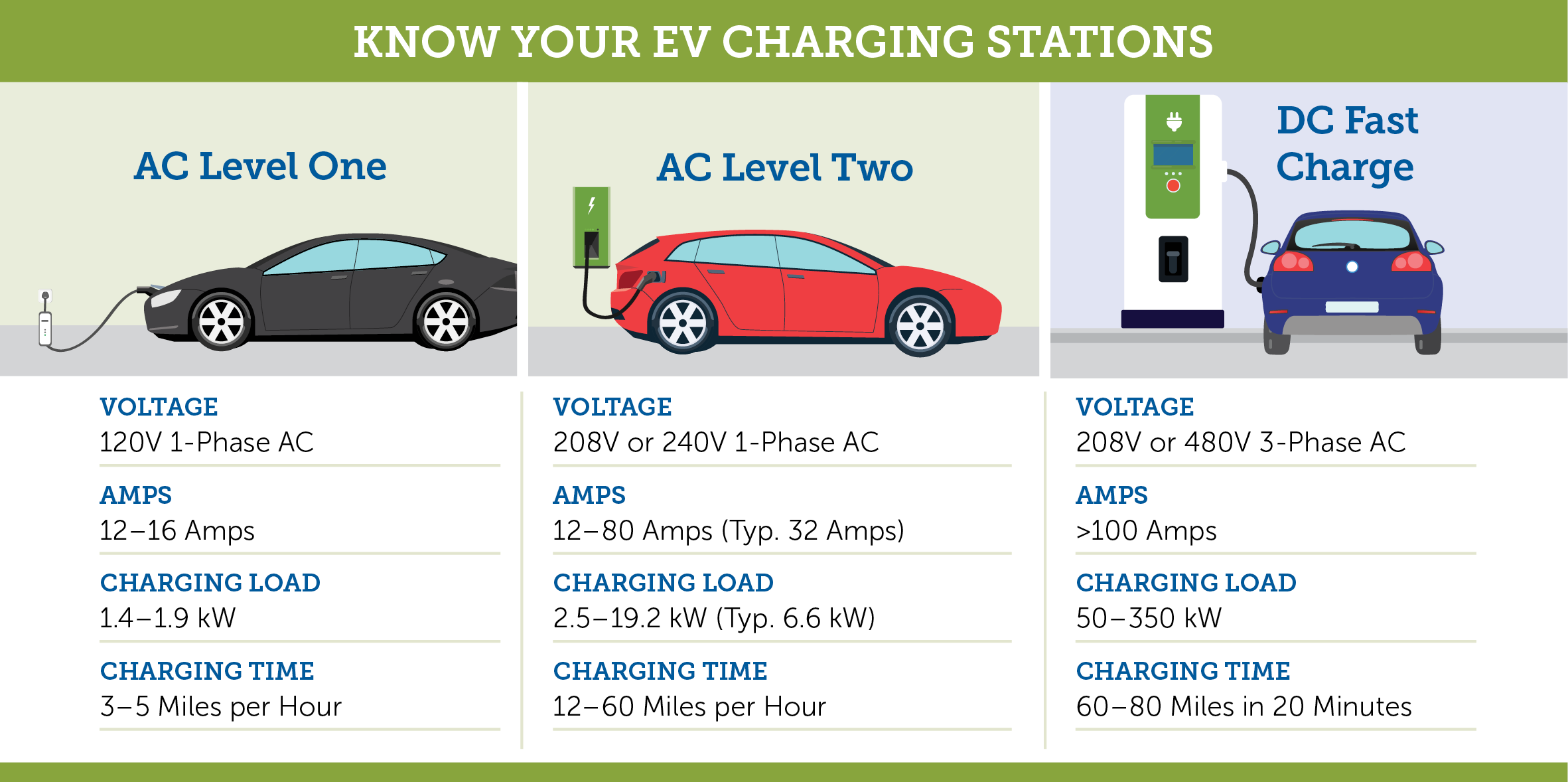

Ev Charging Stations 101 Wright Hennepin

Charge Your Ev Up To 7x Faster With A Level 2 Home Ev Charger

4 Things You Need To Know About The Ev Charging Tax Credit The Environmental Center

Residential Charging Station Tax Credit Evocharge

Tax Credit For Electric Vehicle Chargers Enel X

Best Level 2 Ev Charger Compare Chargepoint Juice Box Grizzl E Siemens Blink More

How To Choose The Right Ev Charger For You Forbes Wheels

2022 Electric Vehicle Ev Charging Rebates Incentives

What S In The White House Plan To Expand Electric Car Charging Network Npr

What Are The Different Levels Of Electric Vehicle Charging Forbes Wheels

Commercial Ev Charging Incentives In 2022 Revision Energy

Us Ev Charging Network Could Finally Become Universal Protocol

Rebates And Tax Credits For Electric Vehicle Charging Stations

Neat Connect Frog Design Strategy Supermarket Design Parking Design

How To Choose The Right Ev Charger For You Forbes Wheels

Find Charging Options For Your Electric Vehicle Carolina Country